Financial institution Loan On-line And Small Enterprise Finance In The US

Your corporation may need cash to increase, buy stock, consolidate debt or buy equipment. The Small Enterprise Administration’s Office of Advocacy additionally reported that loans with a worth of $a hundred,000 to $1 million increased by nearly 32 percent. Advance Funds Community: Advance Funds Community (AFN) presents a variety of flexible enterprise-financing options for small and medium-size businesses, together with unfavorable credit ratings enterprise loans, money advances, bill and buy-order factoring, and gear leasing.

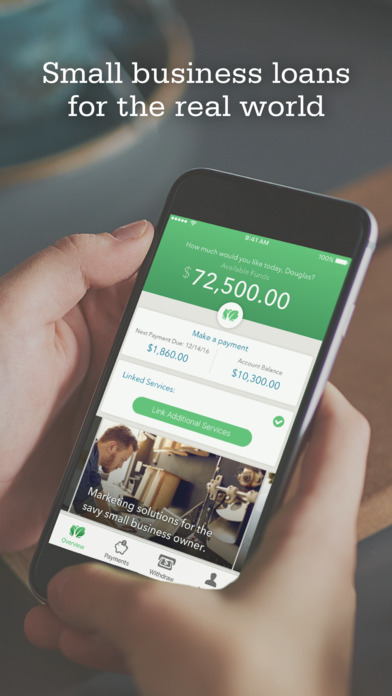

You’ll be able to hyperlink your online financial institution accounts (Chase, Wells Fargo, and so forth.), on-line bank card processing accounts (PayPal, Stripe, and many others.), your vendor accounts (eBay, Etsy, Amazon, and so forth.) and your on-line accounting software (QuickBooks, Xero, etc.) to Kabbage during the utility process.

Banks additionally desire creditworthy debtors, so you could have hassle qualifying if your credit score rating isn’t good. A great business plan ought to act as a pitch for your business and persuade a lender to present you money. Whatever ends you may be pushing your funds by way of to start a brand new business or finance your already operating enterprise, unsecured enterprise loans can afford for that.

Competitive rates of interest: In the case of …