That can assist you discover the precise enterprise loan in 2017, we researched and analyzed dozens of other lenders. Business Loans Direct: Business Loans Direct gives a wide range of loans, including business money advances, merchant money advances, small enterprise loans, merchant loans, restaurant financing, bar and nightclub financing, and medical follow financing.

Biz2Credit can assist small companies get hold of quite a lot of loans, including SBA loans, equipment financing, business-acquisition loans, business loans, strains of credit, franchise loans, real property financing, catastrophe loans and service provider cash advances.

StreetShares is one other great choice for veteran business house owners, significantly if your credit score rating has precluded you from an SBA or financial institution loan. Rates on the CDC loan are tied to the market, meaning that in a low-rate of interest atmosphere, you will get a below-average interest rate that is fixed for the life of the mortgage.

Unsecured Loans: These loans are with none security/ collateral and are focused entirely on the character and reliability of an applicant. The Enterprise Backer: The Business Backer makes a speciality of small enterprise financing. Within the current enterprise enviornment, the money advance has received its personal place as a savior on the financial crises.

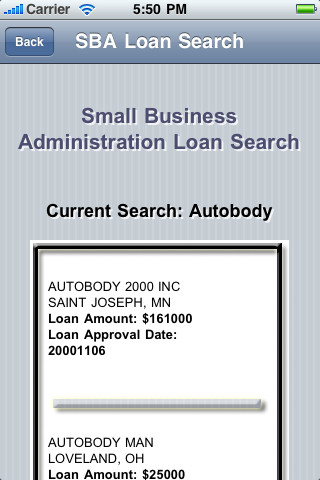

These loans are offered by taking part lenders, which principally contains of American banks as well as some non-bankers who are related to SBA 7(a) program. In the desk under, we’ve got summarized our picks for one of the best small enterprise loans based on quite a lot of needs and sorts of debtors.