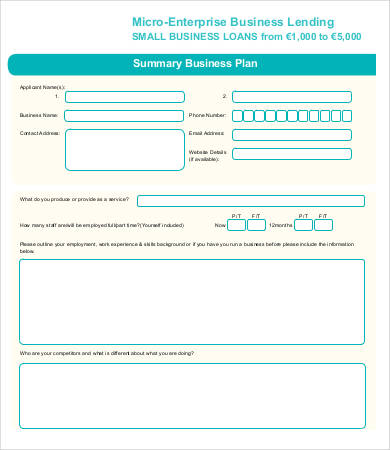

CAMBA Small Business Loans

All that you must apply for a small enterprise loan with Lendio is a few basic details about your company and a few minutes of spare time. The key is, you need to find one of the best lenders who offers enterprise loans for below-average credit in Dallas. Lender require the receipt of your merchant account before releasing the advance, so that he can legally declare his amount as and when bank playing cards are processed.

For those who do not want funds quickly, it’s also best to buy around at totally different banks, credit score unions and various lenders earlier than committing. Aside from that a longer reimbursement period cuts down upon the month-to-month repayments serving to the small business homeowners to handle their finances in a better means.

Because Dallas has some different laws evaluating to different cities and states on the subject of enterprise begin up and business loans. With new business loans you may be credited anything from $15,000 to $ 250,000, depending on the evaluation the collateral you’re mortgaging.

Small enterprise loans for Woman: As a result of an increase in ladies main small businesses, many banking and non-banking establishments are offering special loans that …