Finding Small Business Loans To Generate Capital

The best way that the loans from the Small Enterprise Administration work has the SBA backing up the funds that you will get from a commercial lending institution or a bank. Authorities businesses with procurement authority have an Workplace of Small and Disadvantaged Enterprise Utilization (OSDBU) to advocate inside the company for small companies, as well as help small companies of their dealings with federal companies (e.g., obtaining payment).

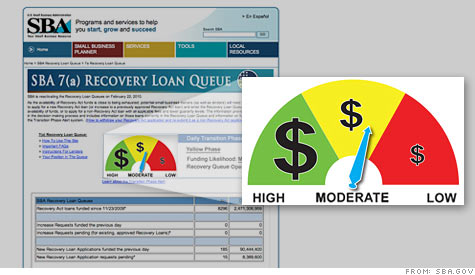

On this local weather, SBA-backed loans turned all of the more necessary as a lifeline to small companies and the federal government acted to lower charges and enhance the quantity of small enterprise loans they would guarantee for banks, from seventy five {b964c5af9f5bab0d5ff6a536efa9e7fd4cd5c0d6c657655a753e63bd41403643} to 90 {b964c5af9f5bab0d5ff6a536efa9e7fd4cd5c0d6c657655a753e63bd41403643} in some circumstances.

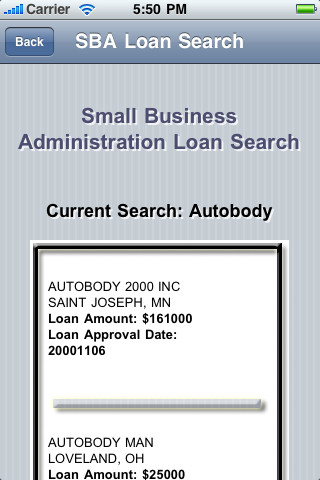

The Small Enterprise Administration (SBA) administers several varieties of applications to help small companies, together with loan guaranty and venture capital programs to reinforce small business entry to capital; contracting packages to increase small enterprise alternatives in federal contracting; direct mortgage programs for businesses, owners, and renters to help their recovery from natural disasters; and small enterprise management and technical help coaching packages to help enterprise formation and enlargement.

P.L. 115-232 , the John S. McCain Nationwide Protection Authorization Act for Fiscal …